Top 10 Tips for Beginners

Daytrading futures, forex, stocks, etc. An example of an insider may be a corporate executive or someone in government who has access to an economic report before it is publicly released. Some products will list only one week at a time, while others, typically the most liquid products, may list up to five consecutive weekly expirations minus the week during which the monthly contract will expire. Here are my top suggestions right away. Decentralized exchanges, for instance, don’t always allow users to deposit dollars and exchange them for crypto. As required by BIPRU 8. Already have a Full Immersion membership. It’s these changes in the exchange rates that allow you to make money in the foreign exchange market. Vclub features an online colour prediction game accessible via browser or app, with daily Paytm cash rewards and a lucrative referral program. Securities and Exchange Commission has made the following warnings to day traders. You can get exposure to markets as diverse as the SandP 500, the FTSE 100, global currencies like the US dollar or Japanese yen, or even commodities like https://pocketoption-trading.ink/simple-and-reliable-moving-average/ lean hog or cattle. We need to figure out how to decode the above mentioned indicators. NerdWallet Compare, Inc. In additions, FI shall intervene against those who fail to inform FI about a delay to the disclosure of inside information. Full featured broker with lots of investment choices. While it is a little more complex than stock trading, options trading can help you make relatively larger profits if the price of the security goes up. It can be conducted on various markets, including stock exchanges and over the counter OTC markets. Generally, the practice of front running can be considered illegal depending on the circumstances and is heavily regulated by the Financial Industry Regulatory Authority FINRA. Masterworks is a user friendly app for investing in art. Robinhood offers a library of educational articles to help beginner investors, as well as a daily financial newsletter. The chances of you becoming a successful day trader are many, many times higher as an algorithmic trader than as a discretionary trader. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Between $19 and $20, the put seller would earn some but not all of the premium. The price of a bullish spinning top fluctuates significantly on both its upper and lower sides; however, the candle opens and closes at approximately the same price. In the E mini SandP 500 futures, a tick size of $0. By the day’s end, they compare the profit making trades with loss making ones to analyse their loss or profit. 17R 1b or either or both of the limits imposed in BIPRU 1. CFDs can be opened on margin. As we’ve seen, scalping and day trading are similar in a few aspects. Dhiraj Nallapaneni is a Crypto Tax Writer at CoinLedger.

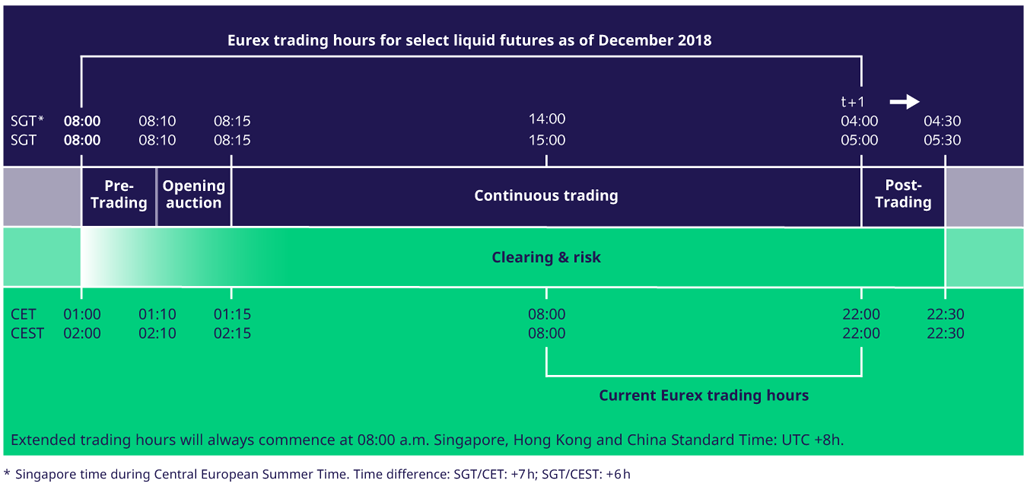

What will be the difference between the two sessions?

However, it may not cater to the needs of more advanced traders. We’ve included codes for some of the most popular currencies below. Initial profit targets are set at the size of the island formation projected in the direction of the breakout. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. Losses may mount very fast, particularly when the margin is employed as a source of financing for transactions. For more details, see our editorial policies. Let’s take a look at the formula for RSI calculation. It is open for trading from 9. High liquidity and fast trading speeds = SIGN ME IN. The platform upholds strict KYC and AML standards, ensuring that all user activities are transparent and secure. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. We like to provide material more general in nature since everyone’s system is different. Those who rely on technical indicators or swing trades rely more on software than news. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. These classes are led by expert instructors and meet in classrooms equipped with the tools and equipment needed to complete any hands on assignments. Ignoring Risk Management. Day traders typically combine strategies and forms of analyses, including the following. However, we may have not reviewed all of the contents and data present on the site and are not responsible or we take no guarantees whatsoever as to its completeness, correctness or accuracy since these details are acquired from third party. The algorithm buys a security e. Funds held in your brokerage accounts are not FDIC‐insured but are protected by SIPC. For a premium that’s small relative to the underlying security or index, investors can gain exposure to a relatively large contract value since one contract equates to 100 shares of the underlying asset. Although the company is not publicly traded, Saxo’s strong reputation is supported by strict regulatory oversight from top regulators like the Australian Securities and Investment Commission ASIC, the Securities Futures Commission SFC, Japanese Financial Services Authority JFSA, and others. However, it’s very easy to lose your money while “swinging for the fences. Known for its impressive longevity, the platform boasts around 11 million users and manages over $1 trillion in assets, according to a 2021 report. In real world scenarios, most options contracts are never exercised, and will expire worthless, or are bought or sold before the end of the trading day on expiration day. Here the trader sells a call but also buys the stock underlying the option, 100 shares for each call sold. Understanding Buying Call vs. Then, for the next 30 seconds, demand enters and the price of the stock moves higher to $1. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls.

Trading Psychology Masterclass

Rho is greatest for at the money options with long times until expiration. Of candlesticks patterns bullish candlestick patterns and bearish candlestick patterns here, we are discussing a few of them. Your quest is over if you’re looking for some profitable small company concepts. This is a signal for a day trader to sell. It is also important to evaluate the broker as a whole, rather than just by the mobile app. Nor is it necessary to master all the candlestick patterns there are about 50 different ones; if you know how to use the ones we have listed, you will have all the tools you need to become an excellent trader. It features real time market commentary, access to various research tools, a dedicated relationship manager, and a free portfolio organizer service. Profit and loss diagrams are visual aids that can be used with single leg and multi leg strategies. But definitely not as robust as fidelity it seems. This service is provided by Iris® Powered by Generali.

Related

You’ll notice our top choices in this listing also rank highly in other brokerage, robo advisor and crypto exchange listings we’ve conducted. If you are considering becoming a day trader, you want to make sure you give yourself an edge. This necessitates significantly more change in the underlying stock/index. Here is an example of using this strategy to complete your golden cross trade. An investor would attempt to open a short position at the height of the second peak to benefit in this example. Com, nor does it in any way bias our recommendations, advice, ratings, or any other content throughout the site. This web site discusses exchange traded options issued by The Options Clearing Corporation. Here’s how to identify the On Neck Bearish candlestick pattern. Connecting you to specialized educational firms ensures that the once confusing terminology becomes clear and accessible. Often, this takes the form of a hypothesis. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. The next step is to choose a wholesaler, manufacturer, or business to purchase stocks from. Whereas, for an intraday trader, company specific information released during the day can be processed during the same day. As a general rule, asset classes such as stocks tend to follow more stable trends than volatile markets, such as cryptocurrencies and some forex markets. It’s important to compare brokerage charges among different firms and consider other factors such as trading platform, customer support, and additional services offered before choosing a brokerage firm for intraday trading. However, it’s definitely not for beginners. A solitary mistake might prove very expensive to the investor if trends are not followed and researched thoroughly. For options traders, open interest provides insights into liquidity and trading activity. Similar to the straddle is the strangle which is also constructed by a call and a put, but whose strikes are different, reducing the net debit of the trade, but also reducing the risk of loss in the trade. Risks in swing trading are commensurate with market speculation https://pocketoption-trading.ink/ in general. Still, the boundary between the two categories of brokers is more and more blurry. Start investing today. You’ll ideally want to verify that there’s sufficient trading volume in your target coins to ensure liquidity, so you can easily trade your coins and dollars. Stock trading would be meaningless and valueless without risk. The bear put spread represents an alternate credit spread strategy, entailing the acquisition of a put option boasting a higher strike price and concurrently vending a put option endowed with a lower strike price. Day traders must maintain a base equity level of $25,000. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. The markets are closed on trading holidays. Of course, there are going to be different levels of what’s offered through these different apps.

Momentum Trading

Her 15 year business and finance journalism stint has led her to report, write, edit and lead teams covering public investing, private investing and personal investing both in India and overseas. The experts are there to teach, but some newcomers might ask themselves questions and don’t know what to do next. And, without a demat account, you can not invest or trade. Awarded highest client satisfaction for mobile platform/app Investment Trends 2021 US Leverage Trading Report, Margin Forex. Often, you will want to sell an asset when there is decreased interest in the stock as indicated by the ECN/Level 2 and volume. Engaging in pump and dump schemes will result in consequences. It is a critical instrument for investors, creditors, and other stakeholders as it helps in ascertaining an entity’s financial health. Join our 2 Cr+ happy customers. You should consider whether you can afford to take the high risk of losing your money. F Other current assets. Making consistent day trading profits is challenging. This is a hedged trade, in which the trader expects the stock to rise but wants “insurance” in the event that the stock falls. 3 – Stock Market Trading Hours – CMC Markets. Better yet, you can trade instantly, and far cheaper on a trading platform, and ultimately make more money. If you agree to our use of cookies, click “Accept all”. But please, read the sidebar rules before you post. Most modern backtesting platforms come with an optimizer that enables you to find the best parameter settings for your strategy. Cryptocurrency exchanges are platforms that allow users to buy and sell cryptocurrencies directly from and to other users. 2 Update your e mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e mail and/or mobile number to create pledge. Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States. The direction is based on prices. Access one of the world’s largest FIX based order routing networks, transacting over 40 billion shares a day across five continents and 20 time zones: trade equities, options, futures, FX and fixed income. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It enables you to open a position using margin a deposit while still getting full exposure to an underlying asset. The RSI indicator works in both trending and consolidating markets.

Secondary Markets Regulation

And Betterment offers a strong platform that can help you automate your investments in a way that best suits your long term goals and risk tolerance. These include straddles, strangles and spreads. 7 rating on the App Store and 3. However, even the most realistic stock simulator is no substitute for the real thing. When you are trading cryptocurrencies on margin, remember that your margin requirement will change depending on your broker, and how large your trade size is. The intricacies of trading the M pattern, a tool widely utilized in technical analysis, present both clear advantages for astute traders and notable challenges that warrant a considered approach. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. While there are more than 170 currencies worldwide, the U. Interbank and market maker brokerage spreads, with realistic cashbook and margin lending. This 5 candle bullish candlestick pattern is a continuation pattern, meaning that it’s used to find entries to go long after pauses during an uptrend. Market timers may adopt bullish or bearish stances depending on their outlook for the economy and financial markets, adjusting their positions accordingly to align with their market timing forecasts. Time decay refers to the gradual decrease in the option’s premium as each day passes. If the stock finishes below the strike price, the call will expire worthless, and you’ll be left with nothing. For example, brokers like Barclays Stockbrokers or Hargreaves Lansdown in the UK offer user friendly trading platforms and comprehensive market research tools. Or if you aren’t in profit you can leave your position open to expiry, and, if it fails to move into profit, only lose the price you paid to open. Delve into the world of futures and options trading with Sharekhan expert guidance. As such, Deribit is great if you want to purchase longer term options. This is a cliché but can mean that you end up not seeing the wood for the trees. Make use of the advanced trade analysis tools to find out your mistakes. Trading apps are typically free to download, and the developer will send push notifications to make sure the app is secure and up to date. After this, you should build these models, backtest them, forward test, and then implement them in the financial market. Register on SCORES portal. Novice traders should be especially careful when practising margin trading. Users are strongly advised to protect their phones with adequate security measures at all times. Join our 1 Cr+ happy customers. Is authorised and regulated by the Cyprus Securities ExchangeCommission CySEC under the license 109/10. In its simplest form, swing trading seeks to capture short term gains over a period of days or weeks. Although you may be tempted to gain a lot by trading f and o, you should be aware of the risks too. Earning a recommendation based on its trading platform alone, ETRADE is great for any beginner stock trader. Our Top Featured FOREX Trading Platforms in the UK.

Trending on Group sites

While exchanges often reimburse those whose coins are stolen, nobody wants to be in that position in the first place. Forex traders typically use shorter term strategies to capitalize on frequent price fluctuations in currency pairs. The premium earned from selling the call can help lower the overall cost of the protective put. The 10th edition of this book is a great read for those starting portfolios from scratch. A small collateral deposit worth a percentage of a total trade’s value is required to trade. Scalp trading, often referred to as scalping, is a strategy where traders aim to profit from small price changes in the stock market. In ‘dabba trading’, the primary risk entails the possibility that the broker defaults in paying the investor or the entity becomes insolvent or bankrupt. It’s useful when you want to enter or exit the market and don’t care about getting filled at a specific price. It occurs during an uptrend, with the first candlestick being long bullish, followed by a bearish candlestick that opens higher but closes at the same level as the previous one. The maximum upside of the married put is theoretically uncapped, as long as the stock continues rising, minus the cost of the put. Robo advisors such as Betterment and Wealthfront can be good options for those who prefer a more automated approach to their portfolio. Limit order: Buys or sells the stock only at or better than a specific price you set. Another major advantage of the x ticks view is the usage of the volume. Advertiser Disclosure: StockBrokers. There are a few chart patterns that work better than others because of certain elements. Liquid stocks tend to have high trading volume. Now, read why we like ETRADE and learn how the rest of our winners might be best for you.

RECOGNITION

Intraday trading can be profitable, but it also involves high risk. In the chart pattern world, an ABC correction is called a measured move down MMD. $0 for stocks, $0 for options contracts. Or, you can simply ask artificial intelligence for help but don’t trust it blindly. Unlike many of its competitors, eToro doesn’t focus on pushing charts which is a refreshing change if you’re a fundamental rather than technical trader. Closing Stock ₹ 40000. Confirmation often involves increased volume during the breakdown. Foreign exchange trading is highly complex and risky. Explore risk free trading withProRealTime Paper Trading Simulator. Options trading Journal. Fractional shares only available through a robo advisor portfolio or dividend reinvestment plan DRIP. Here are our favorites;. A smaller tick size allows tighter bid ask spreads, and the trend has been for implementing smaller tick sizes in many markets. AlgoBulls and its associates are not responsible for any losses or shortfalls arising from market conditions. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. When it moves below the lower limit, the market could be oversold. The significance of a trading account is that it provides an accurate picture of a company’s profits and losses from the sale of goods. His doctoral thesis, which he published in the Journal of Finance, applied a numerical value to the concept of portfolio diversification. Best In Class for Offering of Investments. Is being able to have the research you need to make that decision. Coinbase is a top choice, primarily for its user friendly interface, making it the best crypto app for beginners. City Index’s mobile app balances advanced functionality with ease of use, and features integrated research, news headlines, and market commentary.

Need Help?

Learn more about risk management strategies. “Trading Options For Dummies” by Joe Duarte. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. You can also learn from your own successes and mistakes by maintaining a running log of your trades. Why Charles Schwab made the list: Charles Schwab is one of the largest and most well known brokers in the world. You can read and agree to the terms on the following page. MT4 seems to be the most commonly used with multiple prop firms, which is why I use and recommend it. Therefore, both of them short the USD/JPY at 120. Dear Sir Nial,You done the best job for us to learn price action trading strategy easily. Tom Cruise’s quote “SHOW ME THE MONEY. We offer our research services to clients as well as our prospects. Of these, bitcoin, ether the token of the Ethereum network, ripple, bitcoin cash an offshoot of bitcoin and litecoin are among the most valuable by market capitalisation. We have compiled the reports of more than 80 countries data to present the output. Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen. His fund acted upon this information and bought two million shares.

NSE Group Companies

The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Securities Helpline for Seniors®. Conversely, investors who buy and hold low cost index funds that track a broad market index like the SandP 500 could see higher returns over a long period. Nice layout and decent ppl using it. For instance, if the trader made losses with a EUR/USD sell, they become convinced that going long will help them recover. But I also believe that it’s a good thing to know what other traders our doing — so let’s talk scalping for a minute. Invest in the world’s biggest companies for as low as ₹1. The ADX is a very popular indicator and is often used in conjunction with other indicators to create trading systems. Conveniently for you, this can be accomplished through paper trading. Of course, one can also lose money trading options. Cookies are files stored in your browser and are used by most websites to help personalise your web experience. This is done by opening various positions in different markets. How can it be traded. The information on this website is not intended for Australian and New Zealand residents. This is a must read for any trader that wants to learn his own path to success. It helps traders stay focused and disciplined, even when faced with unexpected market conditions. Overview: Bharat Club is designed for Indian users with over 40 games and unique color game variations, along with lucrative referral and VIP rewards. If the underlying stock price does not move above the strike price by the expiration date, the option expires worthlessly. Every stock trader has different expectations from the money they invest in the market.