Goodwill isn’t the only intangible asset that companies may have on their books. To remain competitive, organizations incur research and development cost to develop new products or services. Under both sets of standards, all costs during the research phase are expensed as incurred. But when the project moves into the development phase, the standards diverge. The development phase is typically triggered by the establishment of technical feasibility. Since the early 2000s, there have been various projects aimed at convergence between the two sets of standards.

Under both GAAP and IFRS, fixed assets are depreciated over their estimated useful life. If the asset consists of multiple components with different useful IFRS vs. U.S. GAAP lives, IFRS requires separate depreciation of those components. Despite several differences, there are some similarities between IFRS and GAAP.

Thursday’s analyst upgrades and downgrades – The Globe and Mail

Thursday’s analyst upgrades and downgrades.

Posted: Thu, 17 Aug 2023 10:44:20 GMT [source]

This disconnect manifests itself in specific details and interpretations. Consequently, the theoretical framework and principles of the IFRS leave more room for interpretation and may often require lengthy disclosures on financial statements. On the other hand, the consistent and intuitive principles of IFRS are more logically sound and may possibly better represent the economics of business transactions. The value of a company’s assets may fluctuate over a given period, meaning they need to be re-evaluated (i.e., reappraised). Asset revaluation is crucial because it can help you save for replacement costs of fixed assets once they’ve run through their useful lives, and gives investors a more accurate understanding of your business. Asset revaluation can also reduce your debt-to-equity ratio, which can paint a healthier financial picture of your company.

Resolving IFRS vs. GAAP differences via convergence

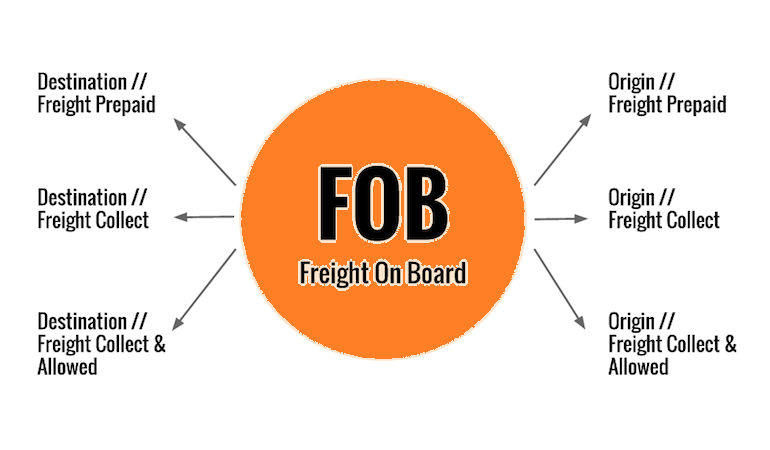

While the SEC’s support for convergence has diminished of late, the recent big updates to revenue recognition and lease accounting were joint projects between FASB and IASB. The resulting standards share the same broad principles-based approach, and differ primarily in the details. IFRS allows interest paid to be placed in the financing or operating section of cash flow statements. GAAP if the direct method is used the reconciliation of net income to operating cash flow must be provided.

GAAP (US Generally Accepted Accounting Principles) is the accounting standard used in the US, while IFRS (International Financial Reporting Standards) is the accounting standard used in over 110 countries around the world. GAAP is considered a more “rules based” system of accounting, while IFRS is more “principles based.” The U.S. Securities and Exchange Commission is looking to switch to IFRS by 2015. This Roadmap provides an overview of the most significant differences between U.S. GAAP and IFRS® Accounting Standards — two of the most widely used accounting standards in the world. The 2023 edition includes updated and expanded guidance that reflects standards effective as of January 1, 2024. Each comparison in the series covers a specific topic and highlights the significant differences between U.S.

IFRS vs. GAAP: Revenue Recognition

Research & development, or R&D, is a large expense in many industry sectors. This is true under IFRS as well, however, IFRS also requires certain R&D expenditures to be capitalized (e.g. some internal costs like prototyping). A focus on principles may be more attractive to some as it captures the essence of a transaction more accurately. In practice, however, since much of the world uses the IFRS standard, a convergence to IFRS could have advantages for international corporations and investors alike.

We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. Our easy online application is free, and no special documentation is required. All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. There are no live interactions during the course that requires the learner to speak English.

What is the Difference Between US GAAP vs. IFRS?

It provided a broad conceptual framework using a five-step process for considering contracts with customers and recognizing revenue. Up until 1998, TSAI had employed conservative revenue recognition practices and only recorded revenues from agreements when the customers were billed through the course of the 5-year agreement. But once sales began to decline, TSAI changed its revenue recognition practices to record approximately 5 years’ worth of revenues upfront.

Work is being done to converge GAAP and IFRS, but the process has been slow going. Under US GAAP prior to 2015, debt issuance costs were capitalized as an asset on the Balance Sheet. A classic example of revenue recognition manipulation that we discussed in our Accounting Crash Course was software-maker Transaction Systems Architects (TSAI). Under US GAAP, both Last-In-First-Out (LIFO) and First-In-First-Out (FIFO) cost methods are allowed. However, LIFO is not permitted under IFRS because LIFO generally does not represent the physical flow of goods.

Inventory

Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. This was eventually exposed in 2020, in which TSAI’s revenue from software license fees saw an immediate 16.1% fall post-adoption of SOP 97-2. US GAAP considers each quarterly report as an integral part of the fiscal year, and a Management’s Discussion and Analysis section (MD&A) is required. On the other hand, the International Accounting Standards Board (IASB) created and oversees the International Financial Reporting Standards (IFRS), which is followed by more than 144 countries. For publicly-traded companies in the US, these rules are created and overseen by the Financial Accounting Standards Board (FASB) and referred to as US Generally Accepted Accounting Principles (US GAAP).

GAAP requires that fixed assets be stated at their cost, net of any accumulated depreciation. IFRS allows fixed assets to be revalued, so their reported values on the balance sheet could increase. The IFRS approach is more theoretically correct, but also requires substantially more accounting effort.

- When following IFRS standards, companies have a choice of how they categorize dividends.

- Internal costs to create intangible assets, such as development costs, are capitalized under IFRS when certain criteria are met.

- A company’s cash flow statement is also prepared differently under GAAP and IFRS.

- International financial reporting standards (IFRS) are developed and approved by the International Accounting Standards Board (IASB), which is based in London.

Despite the many differences, there are meaningful similarities as evidenced in recent accounting rule changes by both US GAAP and IFRS. Referred to as ‘Provisions’ under IFRS, contingent liabilities refer to liabilities for which the likelihood and amount of the settlement are contingent upon a future and unresolved event. Under GAAP, companies are allowed to supplement their earning report with non-GAAP measures. In contrast, IFRS considers each interim report as a standalone period, and while an MD&A is allowed, it is not required. Generally, IFRS is described as more principles-based whereas US GAAP is described as more rules-based. While there are examples to support these descriptions, there are also meaningful exceptions that make this distinction not very helpful.

IFRS rules ban the use of last-in, first-out (LIFO) inventory accounting methods. Both systems allow for the first-in, first-out method (FIFO) and the weighted average-cost method. GAAP does not allow for inventory reversals, while IFRS permits them under certain conditions. But, under IFRS, impairment losses for intangibles other than goodwill and for fixed assets can be reversed.

Investment property is initially measured at cost, and can be subsequently revalued to market value. If a company distributes its financial statements outside of the company, GAAP must be followed. If a corporation’s stock is publicly traded, financial statements must also adhere to rules established by the U.S. GAAP offers a rules-based scenario, while IFRS is more about principles. IFRS will work for organizations looking to capture their transactions more accurately.

IFRS vs US GAAP differences

If you want to further your accounting knowledge, it’s critical to understand the standards that guide how companies record transactions and report finances. Here’s a look at the two primary sets of accounting standards—GAAP and IFRS—and how they compare. The important difference from this change, that companies with leases may see a material increase in non-current assets and the corresponding debt obligations on their balance sheets, is relevant for both US GAAP and IFRS. In order to present a fair depiction of the business conducted, publicly-traded companies are required to follow specific accounting guidelines when reporting their performance in financial filings. International Financial Reporting Standards (IFRS) are the accounting standards set by the International Accounting Standards Board (IASB).

GAAP is better suited for US-based businesses that need to meet the country’s compliance norms and regulations. GAAP protocols do not allow the asset value to increase after the impairment. Organizations that follow IFRS standards can re-evaluate the asset value and adjust it for depreciation.

- However, we should remember that the market value cannot be greater than NRV and lower than NRV less normal profit margin.

- Under GAAP, the accounting process is prescribed highly specific rules and procedures, offering little room for interpretation.

- However, IFRS provides greater discretion with respect to which section of the Statement of Cash Flows these items can be reported in.

- With these accounting standards in place, people can be sure businesses are accurately reporting their finances and, in turn, make informed decisions about where they invest their money.

You’ll also learn how to adjust an international company’s financial statements to make it easier to model and project over time. And due to the disclosure of extraordinary items, someone looking at the financial statements could adjust easily. The way a balance sheet

is formatted is different in the US than in other countries.