An implicit cost is any cost that has already occurred but not necessarily shown or reported as a separate expense. It represents an opportunity cost that arises when a company uses internal resources toward a project without any explicit compensation for the utilization of resources. This means when a company allocates its resources, it always forgoes the ability to earn money off the use of the resources elsewhere, so there’s no exchange of cash.

In other words, economic profit is the revenue a company generates minus the cost of doing business and any opportunity costs. These costs represent a loss of potential income, but not of profits. Implicit costs are a type of opportunity cost, which is the benefit that a company misses out on by choosing one option or alternative versus another. The implicit cost could be the amount of money a company misses out on for choosing to use its internal resources versus getting paid for allowing a third party to use those resources. For example, a company could earn income from renting out its building versus the revenue earned from using the building for manufacturing and selling its products.

What are Explicit and Implicit Costs?

Explicit costs are the out-of-pocket expenses incurred by a business in the production of goods or services. These costs are easily identifiable and can be directly attributed to a specific activity or business function. By accurately tracking explicit costs, businesses can make informed decisions about pricing, production, and resource allocation. Overall, businesses should carefully monitor their explicit costs to ensure that they are managing their resources effectively and making sound financial decisions. If you’re running a business, one of your primary goals will be to make a profit.

In order to find out what your profit is, you must understand what implicit and explicit costs are and how they differ. You will deal with both types of costs while doing business and must use them to determine accounting and economic profit and opportunity cost, among other things. Whether you realize it or not, you deal with both implicit cost and explicit cost while doing business.

In psychology and the study of memory, the words implicit and explicit are used to describe two different kinds of memory. Explicit memory refers to information that takes effort to remember—the kind we need to think hard about to dig out of our memory bank. Implicit memory, on the other hand, refers to information we can recall very easily or even unconsciously. Adding on to that, both words have multiple meanings—sometimes they’re opposites, and sometimes they simply mean different things. For example, cleaning staff may spend hours cleaning a room but receive no monetary compensation for their efforts.

New Study Explores Overcoming Stigma in Hiring People with … – Newswise

New Study Explores Overcoming Stigma in Hiring People with ….

Posted: Mon, 31 Jul 2023 21:30:00 GMT [source]

The adjective explicit describes something that has been expressed directly. For example, saying We gave them explicit instructions means that the instructions were stated in detail. Something that’s described as explicit doesn’t leave anything up to interpretation. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

What Is an Implicit Cost?

There are a few reasons why explicit costs are helpful when estimating a project’s cost. First, they help you to avoid overspending on items that aren’t really necessary for the project. For example, if you’re building a fence, you might not need to spend as much money on materials if you know that the total cost of the project will be $1,000.

Explicit Cost refers to the one paid to the factors outside the firm. Conversely, Implicit Cost are the one that arise from using the asset rather than renting it out. There are a number of differences between explicit cost and implicit cost, which has been explained in the article presented below, have a look. The implicit costs are important for a deep analysis of how a particular economic activity can or cannot be potentially more beneficial than others. The idea of implicit cost can be a little hard to grasp for individuals with not much exposure in economics.

Calculating explicit cost vs. implicit cost

It is the value of sacrifice made by the entity at the time of exercising some other action. The cost occurs when an asset is used as a factor of production by the entity instead of renting it out. Explicit Costs are the costs which involve an immediate outlay of cash from the business. The cost is incurred when any production process is going on, or activity is conducted in the normal course of business.

Implicit costs are not direct expenses incurred, but are potential profits/benefits foregone by firms due to conducting business. Explicit costs are also called out-of-pocket costs, accounting costs and outlay costs whereas implicit costs are also known as imputed costs, notional costs, and implied costs. In the fields of accounting, finance and economics, many different approaches are followed to group or categorize business costs. However, on the basis of payments, two major types of costs are explicit costs and implicit costs. In this article, we will clarify the basic difference between these two types of costs and help you identify which type of cost you’re dealing with while operating your business.

Explicit costs are tracked within the accounting records, because they involve the payment of cash to third parties. Examples of explicit costs are compensation, rent, and utility costs. All of these costs appear in a firm’s income statement as expenses.

A company can have a positive accounting profit while maintaining a zero economic profit. These costs have already occurred but may not be tracked or reported as separate expenses. These could be opportunity costs, such as when a company uses an asset they already have rather than renting or buying it. These costs are sometimes referred to as accounting costs, meaning they are easy to identify and easily identifiable based on the expenses attributed to which business activity.

An explicit costs are measurable and will be included in profit/loss accounts. For example, if the firm hires a new worker, their salary will be an explicit cost which will be put on the accounting balance sheet. For example, to welcome the new worker and train him to a necessary standard may take the time of the manager, who cannot do other tasks as he trains the new workers.

Explicit Costs vs. Implicit Costs

Now that you have some background information on explicit vs. implicit costs, let’s take a look at how to calculate explicit cost and implicit cost for your business. Explicit Costs show that payment has been made to outsiders, while business is carried on. The recognition and reporting of the explicit cost are very easy because they are recorded when they arise. They show that an amount has been spent over a business transaction. Explicit Costs are the costs that you explicitly pay for something- like buying a product, renting an apartment, or filling out a job application. Implicit Costs are the costs that you don’t have to pay for, but that influence your decision – like the cost of time spent commuting or missed wages from not having a job.

- Implicit costs are technically not incurred and cannot be measured accurately for accounting purposes.

- On the contrary, the measurement of implicit cost is subjective in nature because they are incurred indirectly and have no track.

- Explicit costs are realized and used by accountants to determine the net accounting profit or net accounting loss figure to be reported in the financial statements.

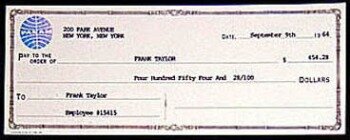

An explicit cost is a cost that is directly incurred by the firm, company or organization during the production period. In this type of cost, the outflow of cash takes place to utilize the factors of production. The record of the explicit cost is noted by the accountant of the company, and can easily be traced as each and every of the expenditure is carefully noted, and is kept as a record. The transfer or outlay of cash takes place through cheques or hand-to-hand, and that too is kept in record. The explicit cost includes rent, salary, wages, stationary, and other expenses which are paid by the company during the process of production. For example, when labors and employees are given salary the outlay of cash takes place, and as a replacement of this salary and wages, the employees offer their work and efforts.

Difference between explicit costs and implicit costs:

When it comes to your business, one of your main goals (if not your biggest goal) is to make a profit. And to find profit, you may need to look at explicit and implicit costs. Explicit costs are those which are clearly stated on the firm’s balance sheet, whilst implicit costs are not. When combined together, explicit and implicit costs make up what is known to be the total economic cost. This is because the cost of choosing option A has an explicit cost as well as an implicit cost of what could have been achieved otherwise. Explicit costs are normal business costs that appear in a company’s general ledger and directly affect its profitability.

The speaker isn’t outright telling you not to press the button, nor do they say what exactly will happen if you. Rather, they are insinuating—implying, hinting—that something bad will happen if you press the button. In contrast, the adjective implicit describes something that has been implied—meaning it has been suggested or hinted at but not actually directly stated or expressed. For example, saying We had an implicit agreement means that the agreement was implied but never actually stated or written down.

Explicit costs are easy to identify, record, and audit because of their paper trail. Expenses relating to advertising, supplies, utilities, inventory, and purchased equipment are examples of explicit costs. Calculating explicit costs is much easier than calculating interview with nacho andrade from adp innovation center implicit costs. Add your business expenses together that are tracked in your record-keeping system to calculate your overall explicit cost. Because these costs will vary drastically from company to company, there is no specific formula to compute these costs.

Impact of U.S. Supreme Court’s Affirmative Action Decision on … – JD Supra

Impact of U.S. Supreme Court’s Affirmative Action Decision on ….

Posted: Tue, 01 Aug 2023 17:22:08 GMT [source]

Explicit costs are the only costs necessary to calculate a profit because they have a direct impact on the company’s bottom line. You can plug this amount into other formulas, like the accounting or economic profit formulas, to find out financial information for your business. With implicit costs, you do not track them like business expenses in your books. Instead, you can calculate implicit costs to determine economic profit and help make smart business decisions.